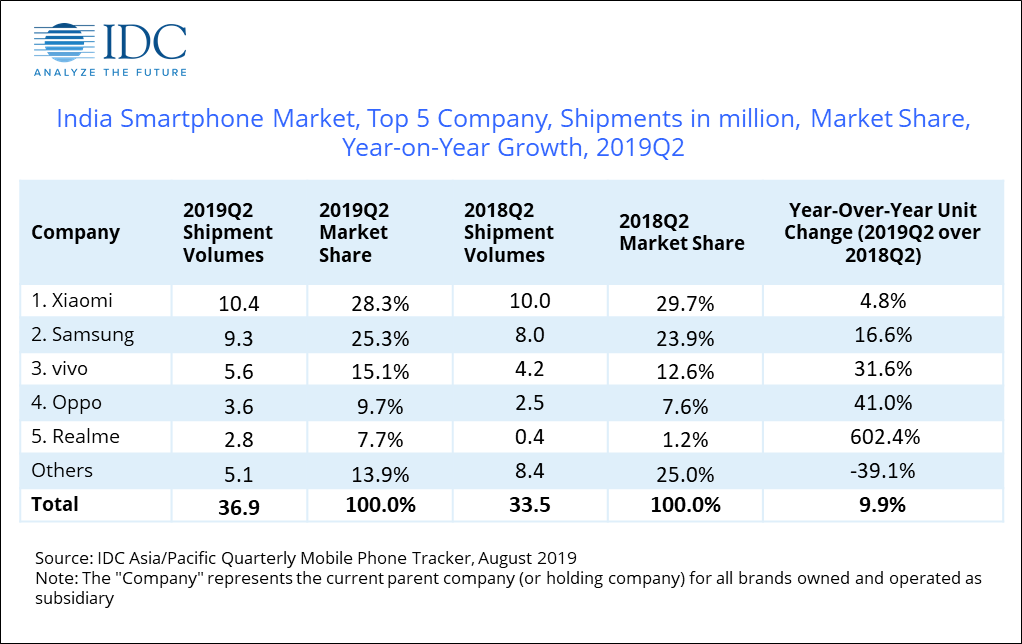

Indian smartphone market witnessed highest ever second quarter shipment totalling 36.9 million in the second quarter of 2Q19, registering a 9.9 per cent year-on-year (YoY) and 14.8 per cent quarter-on-quarter (QoQ) growth. A total of 69.3 million mobile phones were shipped to India in the second quarter of 2019, an increase of 7.6 per cent over the previous quarter.

Driven by the new Samsung Galaxy A-series, marketing activities by Vivo during IPL (Indian cricket league) and Xiaomi’s growing multichannel distribution, the offline channel registered an 8.5 per cent YoY. The feature phone market continued its decline with 32.4 million-unit shipments, registering a drop of 26.3 per cent YoY in Q2 2019. This was due to lower shipments of 4G-enabled feature phones with 40.3 per cent YoY decline in Q2 2019. The 2G feature phone segment also declined as challenges remain for Indian brands along with small players facing heat owing to duty hikes on imports.

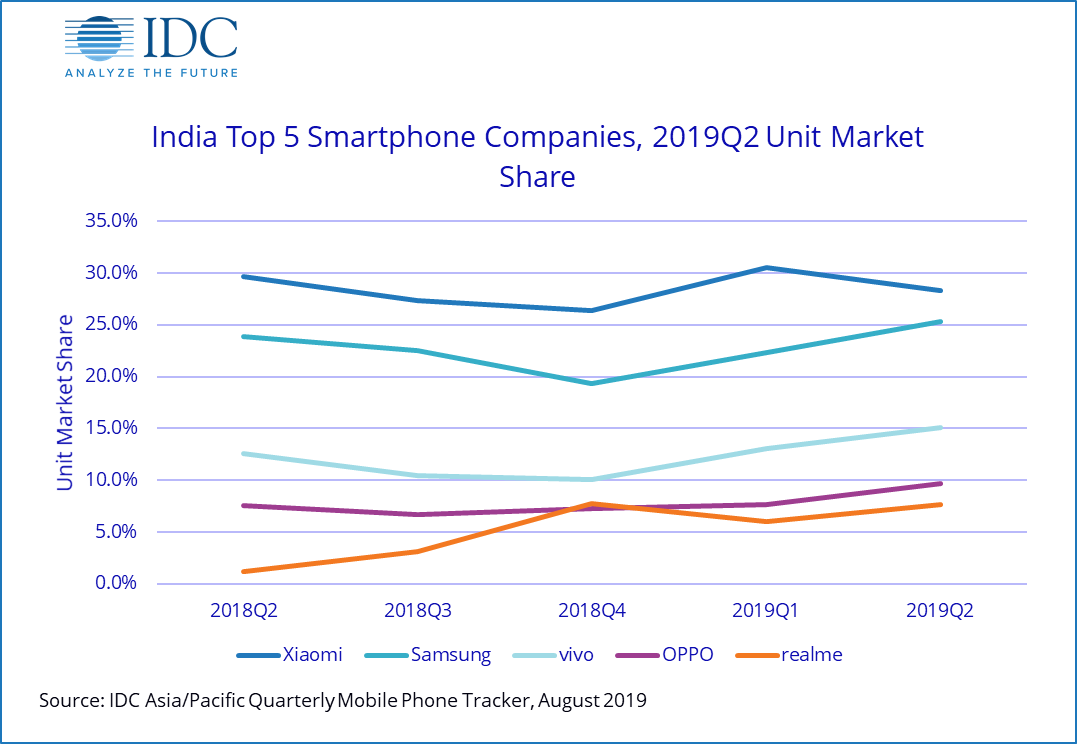

Top 5 smartphone vendor highlights

Xiaomi’s shipment volume grew by 4.8 per cent YoY in Q2 2019 with Redmi 6A and Redmi Note 7 Pro as the highest shipped models in the overall market. Xiaomi also maintained its dominance in the online channel with a market share of 46.5 per cent, along with growing footprint in the offline channel which accounted for 39.5 per cent of Xiaomi shipments in Q2 2019.

Samsung registered a strong 16.6 per cent YoY growth in 2Q19. The Galaxy A10 and the A2 Core were among the top five models in the overall market.

Vivo saw a YoY growth of 31.6 per cent in Q2 2019. Its affordable model Y91 featured in the top five model lists nationally. The company launched its first online exclusive ‘Z1 Pro’ priced aggressively in the sub-Rs 20k segment.

Owing to the affordable A series including A3s, A1K and A5s, Oppo saw a YoY growth of 41 per cent. Online channel accounted for 19.1 per cent for the vendor-driven by online exclusive model K1.

Driven by C2, Realme 3 and Realme 3 Pro, Realme saw a multi-fold growth YoY in Q2 20019. Realme stood second in the online channel with 16.5 per cent market share in Q2 2019, along with ongoing efforts for expansion in the offline channel which accounted for 21 per cent of its shipments in Q2 2019.

‘Despite the efforts towards multi-channel retailing by almost all vendors, the online channel continued its growth momentum fuelled by multiple new launches, attractive offers and affordability schemes like EMIs/cashbacks. This resulted in YoY growth of 12.4 per cent for the online channel with an overall share of 36.8 per cent in 2Q19,’ said Upasana Joshi, Associate Research Manager, Client Devices, IDC India.

With 16.3 per cent YoY growth, the $400-$600 was the second-fastest-growing segment in the Q2 2019 and OnePlus led this segment with a 63.6 per cent share thanks to the OnePlus 7 series. In the premium segment (>$500), Apple stood first with an overall share of 41.2 per cent in as the iPhone XR demand saw an uplift after the price drop and was aided by heavy promotional activities. Apple was followed by Samsung.